What is Decentralized Finance (DeFi)? A Game-Changer in Financial Systems

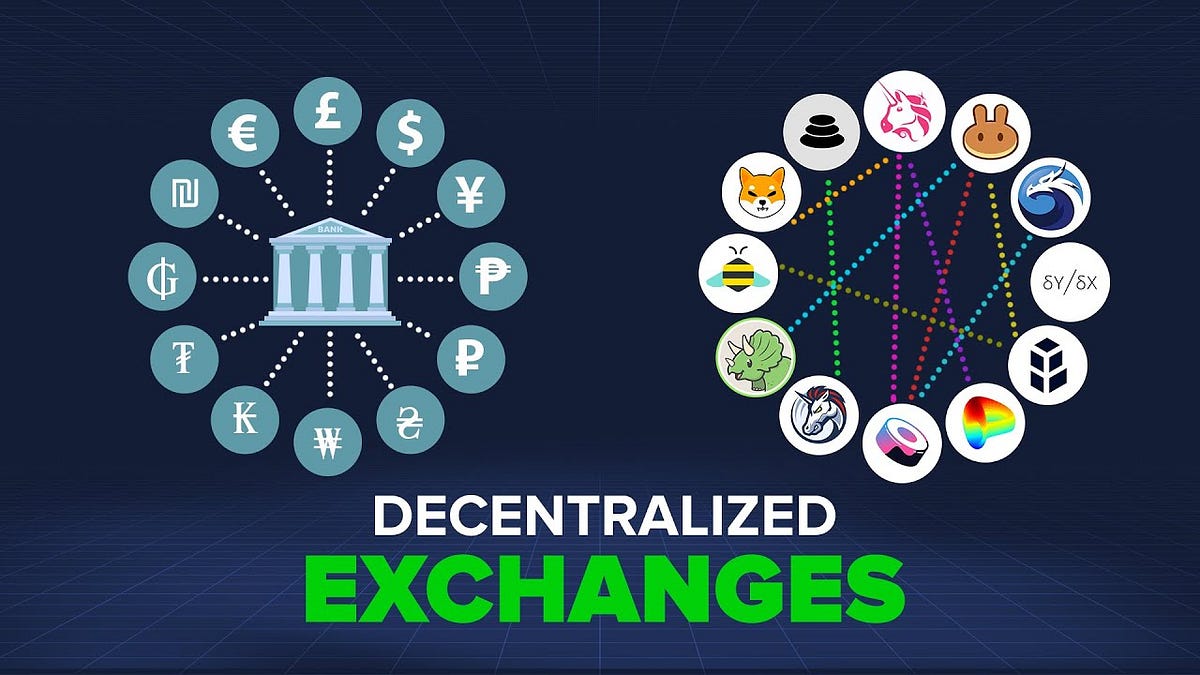

DeFi refers to a blockchain-based financial ecosystem that leverages decentralized technologies to offer financial services without intermediaries. Unlike traditional systems dominated by centralized accounting services or banks, DeFi operates on distributed ledgers, primarily using smart contracts on platforms like Ethereum.

Key Characteristics of DeFi

-

Decentralization: No central authority controls the system. Instead, it operates on peer-to-peer networks using blockchain.

-

Transparency: Transactions are visible on public ledgers, ensuring accountability.

-

Accessibility: Anyone with an internet connection can access DeFi applications, making financial services available globally.

How DeFi Differs from Centralized Finance

Traditional finance relies on centralized accounting systems, billing methods, and marketing strategies. In contrast, DeFi removes intermediaries, allowing users direct access to financial tools like lending, borrowing, and trading.

The Rapid Growth of DeFi

Over the past few years, DeFi has grown exponentially, with billions of dollars locked in DeFi protocols. This trend is driven by the promise of financial inclusion, innovation, and higher returns compared to conventional financial instruments.

Decentralized Billing: Revolutionizing Payments and Transactions

Billing systems are integral to any financial or e-commerce platform. Traditionally, centralized billing systems dominate, but decentralized billing is emerging as a disruptive alternative.

What is Decentralized Billing?

Decentralized billing leverages blockchain technology to record and process payments without relying on a centralized authority. Transactions are verified and recorded on a distributed ledger, enhancing transparency and security.

Benefits of Decentralized Billing

-

Transparency: All transactions are publicly recorded, reducing fraud and errors.

-

Cost-Effectiveness: It eliminates the need for intermediaries, reducing transaction fees.

-

Global Accessibility: Decentralized billing enables cross-border payments without needing traditional banking infrastructure.

Use Cases in DeFi and E-commerce

-

Decentralized e-Commerce: Platforms are integrating decentralized billing to streamline payments and improve trust between buyers and sellers.

-

Subscription Services: Decentralized billing systems are being used for recurring payments, ensuring transparent and seamless transactions.

Challenges and Opportunities

Decentralized billing systems, often powered by blockchain and smart contracts, present transformative potential in financial transactions, especially in automating recurring payments, reducing intermediaries, and enhancing transparency. However, the path toward widespread adoption is not without its challenges.

One major hurdle is regulatory compliance. Because decentralized systems often operate across borders, they face inconsistent or unclear legal frameworks in different jurisdictions. Governments and financial authorities are still adapting to blockchain-based technologies, and questions about data privacy, taxation, anti-money laundering (AML) compliance, and consumer protection are yet to be fully addressed. For decentralized billing to gain institutional support, it must integrate seamlessly with evolving regulatory standards while maintaining the decentralized ethos.

Another challenge is user adoption. Although DeFi (Decentralized Finance) is gaining popularity, many users still lack the technical knowledge or trust to engage with blockchain-based systems. Issues like complex interfaces, wallet management, and gas fees create barriers for non-technical individuals or small businesses. Overcoming these issues will require improved user experience design, better educational resources, and enhanced interoperability with traditional financial platforms.

Despite these obstacles, the opportunities are compelling. Decentralized billing systems offer a transparent, tamper-proof, and automated alternative to conventional billing, which can greatly reduce human error, fraud, and administrative costs. Businesses could benefit from instantaneous settlement, programmable payment conditions, and better recordkeeping through blockchain.

As the DeFi ecosystem continues to mature and infrastructure becomes more robust, decentralized billing systems are poised to disrupt traditional finance. With ongoing innovation, supportive regulation, and user-friendly interfaces, these platforms are expected to evolve from niche solutions to mainstream financial tools, fostering greater financial autonomy and efficiency for users worldwide.

The Role of Centralized Strategies in a Decentralized World

While decentralization is the hallmark of DeFi, centralized strategies still play a critical role in certain aspects of the financial ecosystem.

What are Centralized Strategies?

Centralized strategies involve traditional hierarchical decision-making and control mechanisms. For example, centralized accounting or marketing strategies focus on efficiency, standardization, and regulatory compliance.

Balancing Centralized and Decentralized Approaches

-

Centralized Accounting Services: While DeFi promotes decentralization, centralized accounting services remain essential for tax reporting, auditing, and compliance.

-

Centralized Marketing Strategy: DeFi projects often rely on centralized marketing to attract users and build trust in their platforms.

The Hybrid Model

Many organizations are adopting a hybrid model, combining the efficiency of centralized strategies with the innovation of decentralized technologies. For example, a DeFi platform might use decentralized billing for transactions but leverage centralized accounting for regulatory compliance.

Decentralized e-Commerce: The Future of Online Markets

E-commerce is undergoing a transformation with the integration of decentralized technologies, creating new opportunities for buyers, sellers, and developers.

What is Decentralized e-Commerce?

Decentralized e-commerce platforms operate on blockchain networks, removing intermediaries and enabling peer-to-peer transactions. These platforms use smart contracts to automate processes like payments, dispute resolution, and product delivery.

Advantages of Decentralized e-Commerce

-

Lower Costs: Eliminating middlemen reduces transaction fees and operational costs.

-

Enhanced Security: Blockchain technology ensures secure and tamper-proof transactions.

-

Global Reach: Decentralized platforms enable cross-border trade without traditional banking systems.

Examples of Decentralized e-Commerce in Action

-

Platforms like OpenBazaar allow users to buy and sell goods directly without intermediaries.

-

DeFi applications are being integrated into e-commerce platforms for decentralized billing and payment solutions.

Challenges and Future Prospects

Decentralized e-commerce faces challenges like scalability, user adoption, and regulatory hurdles. However, as blockchain technology matures, these platforms are expected to gain widespread acceptance, reshaping the online marketplace.

Dapp Development: Building Decentralized Applications for E-commerce

Decentralized applications (dApps) are the backbone of decentralized e-commerce, providing the infrastructure for peer-to-peer transactions, smart contracts, and blockchain-based services. The development of dApps is revolutionizing how businesses and consumers interact in the digital marketplace. What are dApps? dApps are software applications that run on decentralized networks, such as Ethereum or Solana, rather than centralized servers. They use smart contracts to automate processes like payments, dispute resolution, and supply chain tracking. The Role of dApps in E-Commerce In decentralized e-commerce, dApps facilitate secure and transparent transactions without intermediaries. For example, a dApp can automate the payment process, ensuring funds are released to the seller only after the buyer confirms receipt of the product. dApps also enable token-based loyalty programs, where users earn rewards in the form of cryptocurrency for engaging with the platform. Steps in Dapp Development 1. Defining Objectives: Identifying the purpose and functionality of the dApp, such as billing, payment processing, or supply chain management. 2. Selecting a Blockchain Platform: Choosing the appropriate blockchain network based on factors like scalability, transaction costs, and developer support. 3. Smart Contract Development: Writing and testing smart contracts to automate processes and ensure security. 4. User Interface Design: Creating a user-friendly interface that simplifies interactions with the dApp. 5. Deployment and Maintenance: Launching the dApp and providing ongoing updates to address bugs and improve functionality. Future Prospects of dApps in E-Commerce As blockchain technology evolves, dApps are expected to play an increasingly central role in e-commerce. Innovations like layer-2 scaling solutions and interoperability protocols will enhance their efficiency and usability, making decentralized e-commerce a viable alternative to traditional platforms.

Legal and Regulatory Challenges: The Need for DeFi Law

As DeFi continues to grow, legal and regulatory challenges are emerging, necessitating the development of specialized DeFi laws.

Key Legal Concerns

-

Regulatory Compliance: DeFi platforms often operate across multiple jurisdictions, making compliance complex.

-

Security and Fraud: The decentralized nature of DeFi makes it vulnerable to hacks and scams.

-

Consumer Protection: Ensuring that users have recourse in case of disputes or losses is a major challenge.

Developments in DeFi Law

Governments and regulatory bodies are beginning to address these challenges by developing frameworks for DeFi. For example, the European Union's Markets in Crypto-Assets (MiCA) regulation aims to establish clear rules for DeFi platforms and cryptocurrencies.

The Role of Legal Experts

Legal experts specializing in DeFi law play a crucial role in helping platforms navigate these challenges. They provide guidance on compliance, risk management, and dispute resolution, ensuring that DeFi projects operate within the bounds of the law.

The Future of Decentralized Finance: Opportunities and Risks

DeFi represents a paradigm shift in the financial industry, offering unprecedented opportunities for innovation and inclusion.

Opportunities

-

Financial Inclusion: DeFi provides access to financial services for unbanked populations.

-

Innovation: Technologies like decentralized billing and dApps are creating new business models and revenue streams.

-

Transparency: The public nature of blockchain enhances accountability and reduces fraud.

Risks

-

Regulatory Uncertainty: The lack of clear regulations poses challenges for DeFi platforms.

-

Scalability Issues: High transaction costs and slow processing times hinder adoption.

-

Security Vulnerabilities: The decentralized nature of DeFi makes it susceptible to hacks and scams.

Balancing Innovation and Regulation

The future of DeFi depends on finding a balance between fostering innovation and ensuring regulatory compliance. Collaboration between developers, regulators, and legal experts is essential to address these challenges and unlock the full potential of decentralized finance.

Conclusion

Decentralized Finance